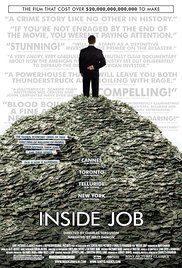

INSIDE JOB

US, 2010, 105 minutes, Colour.

Narrated by Matt Damon.

Directed by. Charles Ferguson)

For most of us, the world economic meltdown of 2008 seems incomprehensible as it raises so many questions as to how alleged financial experts could have been so wrong, so deceitful, so greedy, so amoral if not immoral, in their playing with, unscrupulously gambling, with people’s, institutions’ and nations’ money.

I would not like to have to do an exam on what I learned and remember from watching Inside Job, the details and the intricacies, let alone the terminologies, were too much for me. But, I am glad (in a morbid kind of way) that I have seen the film.

For those in the money know, there is a lot of information about how the American banks, especially, the bankers, the financial advisers to the Bush, Clinton, Bush and Obama administrations got their positions and maintained them, despite the upheavals. While many of the top people involved declined to be interviewed for the film, there are enough interviews to explain what went on. (The academics from American universities who sit or sat on bank boards, wrote highly paid papers and acted as government consultants, come across as an alarming group of mercenary types as well.)

Interestingly, the film opens with the crisis in Iceland and its bankruptcy in 2008 offering some background as to how this could come about. This gets us in the vein to explore the American situation and its consequences. As we listen (without always understanding the detail and keeping abreast of the events), we realise that we are not looking at a group of naive innocents who were doing their best in terms of honesty and open fair dealing. We are looking at a culture that fostered greed and risk, that was made up of many men (more than women) who aspired to a lavish, sometimes decadent, lifestyle, many of whom still do not have the decency to be honest and who remain in positions of power and influence. Statistics about bonuses (to which we have become accustomed, perhaps) are still appalling in the huge (sometimes ultra-huge) amounts that individuals walk away with even as Lehman Brothers, Goldman Sachs, AIG and so many others are in dire straits.

Communism collapsed at the end of the 1980s. Capitalism has been thoroughly shaken by this global meltdown. While human nature remains corruptible, we owe a debt to the media (which does not always avoid corruptibility either) which can produce articles which analyse and warn, interviews that alert us to dangers as well as showing confessions of wrongdoing, documentaries that assemble facts and figures which can inform and influence for change.

This film could be a companion piece to Michael Moore’s 2009 Capitalism: A Love Story. (And for those who prefer a movie story that dramatises these issues, Wall Street: Money Never Sleeps (with Gordon Gecko’s reminder, ‘I once said, ‘Greed is good’; now it’s legal’.) and the drama of investment risk, Margin Call, with Kevin Spacey and Jeremy Irons.)